Choosing the right asset allocation is one of the most important things you’ll ever do as an investor. In this post, I’ll look at what things can be classified as assets and how owning a mix of them can lower your overall investment risk.

What is an Asset?

An asset is defined by Investopedia as “anything of value that can be converted into cash.” Things that are assets include:

An asset is defined by Investopedia as “anything of value that can be converted into cash.” Things that are assets include:

- Cash – money in a term deposit, chequing or savings account, and even money under your mattress!

- Investments – these can be stocks, bonds, mutual funds, pensions, RRSPs or 401ks.

- Real estate – land, commercial property, recreational property, residential property etc. This includes the land itself plus any structures that exist on that property.

- Commodities such as gold and silver.

- Personal property – Jewellery, coin collections, art collections and other alternative types of investments. To a lesser extent you may include depreciating assets like cars, boats, motorcycles etc.

Studies have shown that owning a mix of assets (especially the first 3 listed above) can produce superior long term investing results with less risk. These asset classes are the building blocks of something called an asset allocation model.

Building an Asset Allocation Model

Formulating an asset allocation model involves 2 things: time horizon and risk tolerance. In general, owning a little bit of everything beats owning a lot of one thing because the risks associated with investing is spread around. It is impossible to completely eliminate all the potential risks to investing, but it is possible to mitigate those risks by following a diversified asset allocation model.

In simple terms, asset allocation refers to where someone chooses to place their money and is determined by their financial goals. For example, if a person has a short-term goal, then they’ll have a more conservative investment orientation and they would look at holding cash in a high interest savings account or some type of short duration GIC. Alternatively, if they had a medium or long-term time horizon to meet their goal, then they would typically be looking at a mix of the three major asset classes – cash and equivalents, fixed income (ie. bonds) and equities.

At the height of the Global Financial Crisis in early 2009, John Bogle, the former CEO of Vanguard, offered an important insight about asset allocation. He wrote: “Never underrate the importance of asset allocation. Investing is not about owning only common stocks. Nor are historical stock returns a sound guide to future returns. Virtually all investors should keep some ‘dry powder’ in their portfolios in the form of high-grade short-and intermediate-term bonds. Investors who failed to learn that lesson fell on especially hard times in 2008.”

Bogle’s insight highlights the importance of proper diversification, which is simply not putting all your eggs in one basket. You want to diversify your investments by buying different kinds of assets that are negatively correlated to one another or, put another way, that move in different directions to one another.

Diversification Reduces Investment Risks

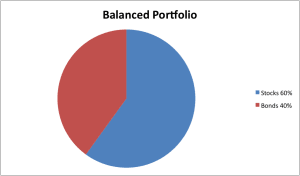

Diversifying among the 3 major asset classes simply means holding a mix of equities, fixed income and cash or equivalents. This is the most important part of diversifying an investment portfolio because it reduces its overall risk.

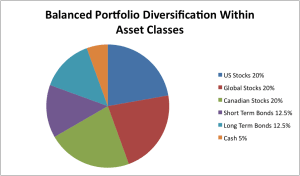

Diversify Among and Within Asset Classes

Once you diversify among the major asset classes you may consider further diversification within them. Below are some examples of this.

Diversifying within the equity component is done by:

- Holding mutual funds or ETFs that track different global markets;

- Holding a mix of small and large cap companies and

- Owning companies in different sectors of the economy.

Diversifying within the fixed income class is done by:

- Owning various fixed income instruments that have different durations,

- Different issuers (ie. government and corporate) and

- Credit quality.

Finally, diversifying within the Cash or equivalents component by using:

- Laddered GICs,

- High interest savings accounts or

- T-bills.

The point is that diversification among asset classes provides a level of protection for investors by not concentrating too much money in any single type of investment.

Examples of Investment Portfolio Diversification

Here is an example of how diversification works in a Balanced Portfolio:

Portfolio Maintenance: the Importance of Re-balancing

Once you’ve figured out your asset allocation, you’re work isn’t completely finished. More and more research shows that developing a diversified asset allocation model and sticking to it is important to successful investing. I’ve found that setting up my initial asset allocation model was simple. Sticking to it, of course, is an entirely different matter altogether. Over time, I’ve found that the proportions I assigned to my asset classes wandered from their original target allocation. When this happens you need to have the discipline to re-balance so that the allocation for each asset class is returned to its original proportion.

From time to time in my Dividend Income / Monthly Highlights posts you may notice that I mention that I’ve done some re-balancing in my investment portfolio. Re-balancing is the maintenance work that needs to be done in an investment portfolio from time to time.

It is good risk management and is one of the most important things to get right. Many people don’t re-balance because it usually means selling some of their best performing assets to buy the worst performing ones. It could also involve simply deploying new money to buy the asset class with the weakest performance.

For most people, this appears counter-intuitive and they simply refuse to do it. After all, who wants to sell a US index fund that returned nearly 30% in 2013, for example, in favor of buying a bond index fund or some other fixed income product that had a slightly negative return? Re-balancing forces us to buy low and sell high and it requires us to be dispassionate about our investments.

Conclusion

Building an investment portfolio according to one’s risk tolerance and time horizon is a relatively easy thing to do. It’s important to remember however, that different assets grow at different rates and that, if left unchecked, over time they can increase the overall level of risk in an investment portfolio.

That’s why it’s important to spend a little time – even just a few minutes once a year – to make some adjustments to your investment portfolio so that it matches your overall risk tolerance and long term financial goals. Over the years I’ve noticed in my own portfolio that this has been one area that I’ve often neglected.

One of my new rules is to start glancing at my asset allocation periodically so that I can better manage my investments. What about you? Do you spend much time on re-balancing your investments? How important is asset allocation to you?

Image credit: Photo by Stuart Miles / FreeDigitalPhotos.net

BeSmartRich

Sunday 8th of March 2015

I should probably look into international exposure. My net worth is 100% tied to US and Canadian markets and 100% dividend paying companies and ETFs. Although I don't have any plans to purchase bonds anytime soon, I will keep my eyes open if good opportunity arises.

Thanks for sharing!

BSR