Welcome to my 2019 Financial Goals. As I do every year, I’ve been thinking about how we fared in 2018 in terms of our financial goals and about where I’d like us to be in 2019.

I want to make the point that improving our financial situation doesn’t just happen magically on its own. We all need to plan for it, and a great way to get started is to set some goals. They don’t have to be anything crazy, it can be as simple as earn an extra $100 a month or contribute $25 a week to an RRSP or TFSA. Or pay down $X amount of debt. We all need to start somewhere.

If you want to build wealth start tracking your income and expenses, then set some goals to challenge yourself to do more. I’ve done this for years and it’s served me well so if your struggling financially give it a shot.

Just to recap, we had 4 major goals last year so let’s see how we fared.

2018 Financial Goals in Review

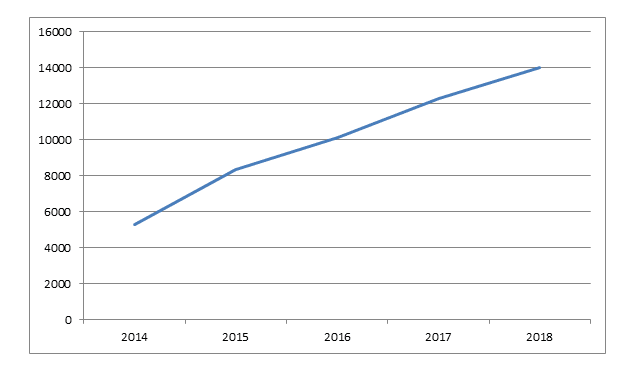

1) Earn 14k in passive dividend income. This should be achievable if we invest in our registered accounts, continue to re-invest our dividend income and get some nice dividend increases.

This one was a real nail-biter for me because by December I had some doubts that we would actually achieve it. In the end, we just made it! We earned a total of $14,032.58 in passive dividend income.

2) Max out RESPs. Our children’s future education is important to us so we will continue to save towards it.

We met this goal as well.

3) Max out our registered accounts. Our retirement accounts and other tax-free accounts will be maxed out this year.

We met this goal too, but not by saving any new money to make the contributions. We moved stocks from our taxable brokerage account into our RRSP and TFSA accounts at Questrade. That’s cheating a bit in my opinion but I had to make those moves out of desperation.

Related Questrade Review

4) Pay down 60k on our mortgage so that it goes below the 300k mark. Interest rates are on the rise and I don’t want to be caught with too much mortgage debt. I think there will be a lot of financial pain for people who aren’t thinking about a pay down strategy for all the debt that they accumulated at record low interest rates.

Now this may seem like a pretty aggressive goal, however, as I look back on it this could have been achieved. But we were blindsided by a number of issues with our home and sunk at least that much into fixing it up. In the end, our regular payments and the lump sums that we made early in the year paid off nearly 37k on the mortgage. So we achieved 61% of this goal.

We also renewed our mortgage for another 5 years at 3.34%. We seriously considered moving a few times last year but in the end we determined the better course was to stay put and slug it out with our home renos.

Related Borrowell Review

2019 Financial Goals :

After a very difficult 2018, I’m determined that we succeed in meeting our 2019 goals. Rather than producing a big list of financial goals, I’m focusing instead on 3 big ones.

1) Net Worth Goal

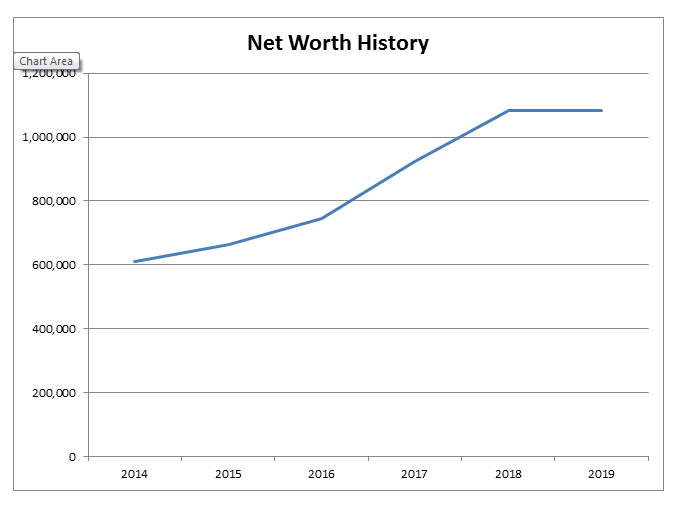

I didn’t have a net worth goal that I was working towards last year, other than just staying above the $1 million mark. And it was a good thing because, with our home renovations and the stock market correction, our net worth hadn’t even moved a bit. (For the record, the true market value of my home is significantly understated in my NW reports).

Well this year I’m making a goal to grow our net worth to at least $1.2 million by aggressively reducing debt and investing as much as we possibly can. As of January 1st, we are at $1,084,269.

Here’s a snapshot of the growth of our net worth since 2014:

2) Passive Income Goal

The Passive Income Goal this year is $17k. That’s a 21% increase over 2018. This should be achievable with regular investing, dividend raises and by re-investing our dividend income.

Here’s a snapshot of the growth of our passive dividend income since 2014:

3) Pay Down Debt

In terms of our debt, 2018 was absolutely brutal for us. We borrowed money from our line of credit to get us through the renovations and now comes the hard part of paying it off. In addition to paying off the line of credit, I want to pay down $20k on our mortgage in addition to our regular payments.

Read my Passive Income reports and weekly recap posts to see what I’m doing to achieve these goals.

Well that’s it for my 2019 Financial Goals, I hope this inspires some of you to create your own financial goals and I wish you all the best in 2019!

Buy, Hold Long

Tuesday 29th of January 2019

Fantastic. Some really nice and achievable goals. Good luck with them :)