Is this Global Banking Crisis 2.0? The global economy faces a major crisis that is rarely discussed or debated but rears its head from time to time in the form of a bank going bust, a pension system collapsing and currencies crashing. The problem is that there is simply too much debt in the system. Consumers, businesses, and governments at all levels are drowning in it.

For over a decade the growing pile of global debt was ignored because interest rates were zero. In fact some places even flirted with negative interest rates! This was all good because there was no inflation to worry about. In fact the biggest worry was disinflation/deflationary forces or so the central banks thought.

Now that we have the highest inflation since the 1970s, with little meaningful signs of it abating any time soon, central banks are forced to deal with it by raising interest rates aggressively in the hopes of nipping it in the bud. But in so doing, they are playing Russian Roulette with the global financial system.

Over the last week, unless you’ve been living under a rock, we watched a number of bank runs on some US regional banks. On Sunday (March 19), Swiss banking giant UBS bought the beleaguered bank Credit Suisse for $3 Billion. This may seem like a lot of money, but it is essentially pennies on the dollar as the bank was effectively bust.

Credit Suisse had been around for 167 years and unlike Silicon Valley Bank, First Republic, Signature, Silvergate, FTX, Celsius etc., it was a GSIB – Global Systemically Important Bank. In other words it was Too Big To Fail. And yet it did. Sure the Swiss authorities tried to make it as painless as possible. And I’m sure the Saudis (who had recently invested billions into the bank) won’t take too much of a loss. But the Swiss National Bank had to pour in tens of billions of dollars to stave off the complete and utter collapse of Credit Suisse.

The Fall of Credit Suisse was the complete opposite of a nothing burger. It necessitated a coordinated approach among Western Central Banks to open up dollar swap lines to provide liquidity in an effort to stabilize the global financial system.

For us average folk this all seems Chinese to us. My understanding of this entire situation isn’t complicated. It’s essentially we have way too much debt and it continues to grow. All of the market chaos since 2007 has been a result of too much debt. Being highly indebted dramatically increases risk…period. So whether it’s a pandemic, a war, natural disasters, rising interest rates, or some unstable bank on the periphery of the system collapsing – all of these can have a catastrophic fallout for a highly indebted system.

Some of you may be asking how do we as small individual investors navigate this storm? I think we all need to deal with the reality that future is fundamentally unknowable but we can dramatically improve our personal situations by getting out of debt or at least reducing as much of it as possible.

I’ve already done this and believe me there is no better feeling than being completely debt free. It can be done but the process isn’t easy or very pleasant. It means saying no to all the stuff we want and delaying gratification – something our society struggles with endlessly.

It also means saving and diversifying our investments into things and into asset classes that have been forgotten and ignored over the past decade or so. For example, Gold, commodity stocks, energy, and even things like Money Market Funds. Yes I said money market funds – most are paying north of 4% which isn’t a bad place to park some cash while we’re waiting for the markets to sort themselves out.

Tangerine is offering GIC rates that I haven’t seen in 20 years!!!

I also mention energy – fossil fuels…oil and gas. Why? Because the entire world continues…and will continue to use oil and gas to maintain their standards of living. Without these irreplaceable energy sources we go back to the Stone Age. The Green Energy revolution has failed.

And as Western societies continue with these hippy dreams the East is playing Real Politik and securing global energy and commodity supplies. Don’t believe me? China just brokered a peace deal between Iran and Saudi Arabia. Look on a map and you’ll see that 40% of global oil supplies transit the Persian Gulf.

I also mention Gold. Yes, that little pet rock. That most unproductive and useless thing that Warren Buffett so derides. So why do I choose to allocate a portion of my asset mix to gold? Simple. I’ve read enough history to understand the problems of the 3 D’s: DEBT, DEFICITS and DEVALUATION.

DEBT: We have way too much debt in the system at every level. I don’t believe we can kick the can down the road anymore. Not once it reached the sovereign level. Either this debt gets defaulted on or it gets inflated away.

DEFICIT: Governments around the World but particularly in the West continue to borrow and spend like drunken sailors. All of the monetary tightening that the central banks have done is effectively being neutralized by governments continuing to run deficits and give everyone free money. This means that inflation will continue which will keep central banks’ hands tied with interest rates.

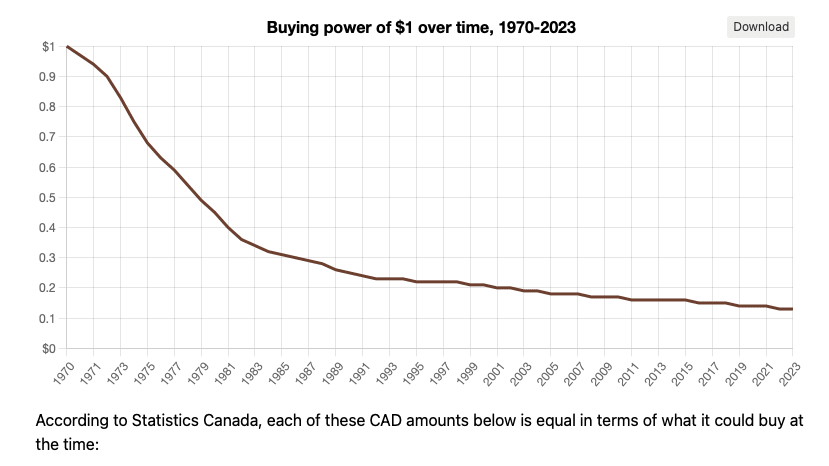

DEVALUATION: the combination of high debt, deficit spending, QE and all the other shenanigans causes currencies to lose value which reduces our purchasing power. That’s why a dollar today buys 87% less than it did in 1970!

At the rate Trudeau spends we’ll get to zero on this chart within a few years.

For a good read check out Adam Fergusson’s When Money Dies.

Gold protects against all of this risk by holding its value in relation to worthless fiat currencies and paper assets like stocks and bonds that can, do and in some cases will go to zero.

I view gold as wealth insurance not a get rich scheme.

Which brings me to my final point. When faced with risky, uncertain times, the prudent investor must be properly diversified and prioritize safety and wealth preservation over gambling on outcomes that are ultimately uncertain.

For a good read about the Asset Bubbles check out Quinn and Turner’s Boom and Bust.

Save, Invest, Build Wealth and Prosper

In case you’re wondering here’s where we park our money and some financial services that we use (please note these are affiliate links where we receive small compensation for signups and sales):

For our precious metals and coin capsules, we use Silver Gold Bull because they price match and offer fast, insured, delivery.

We also own some crypto currencies like Bitcoin and Ether through Shakepay. If you’re interested in buying some here is our referral link to Shakepay and get $10 to try it out. We buy Bitcoin on Shakepay and transfer it to a Ledger cold storage wallet to keep our crypto secure.

For our Daily banking we use Tangerine because they offer incredible products and no-fee banking.

For investing we use a combination of TD Waterhouse (for legacy investments) and Questrade because it offers incredible value with low cost stock purchases and free ETF purchases. If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.

Please note: this page contains affiliate links. As an affiliate, this blog receives a commission for each sign up for Tangerine, Shakepay, Borrowell, Questrade, Amazon, Silver Gold Bull and Bluehost.