Welcome to another recap post on Investing and the Post Pandemic World. These are crazy times. We’re dealing with a global Pandemic and an economic collapse!

Yes we have much to discuss, but first my disclaimer: this post contains affiliate links where the blog may receive a small commission on any sales from EQ Bank, Questrade and Tangerine.

Here’s some good news:

2020 Dividend Income Goal Achieved!

In January and February I was trying to figure out just how to achieve my dividend income goal for the year. My goal was to increase this income by $2k. If the average yield is 4% then I would need to invest $50k to achieve that goal. With stocks trading at sky-high prices, I wasn’t sure that I would be able to bag this goal for the year. Then came the crash!

The stock crash will certainly hit my net worth, but all of my recent buying has propelled my dividend income to new heights! In fact, after looking over the numbers yesterday, I realized that I had already reached my goal for the year!

For income investors, now is a great time to invest. Some banks are yielding nearly 8% with the average around 6.5%. Other dividend stalwarts like utilities and telcos are yielding in the 4%-6% range.

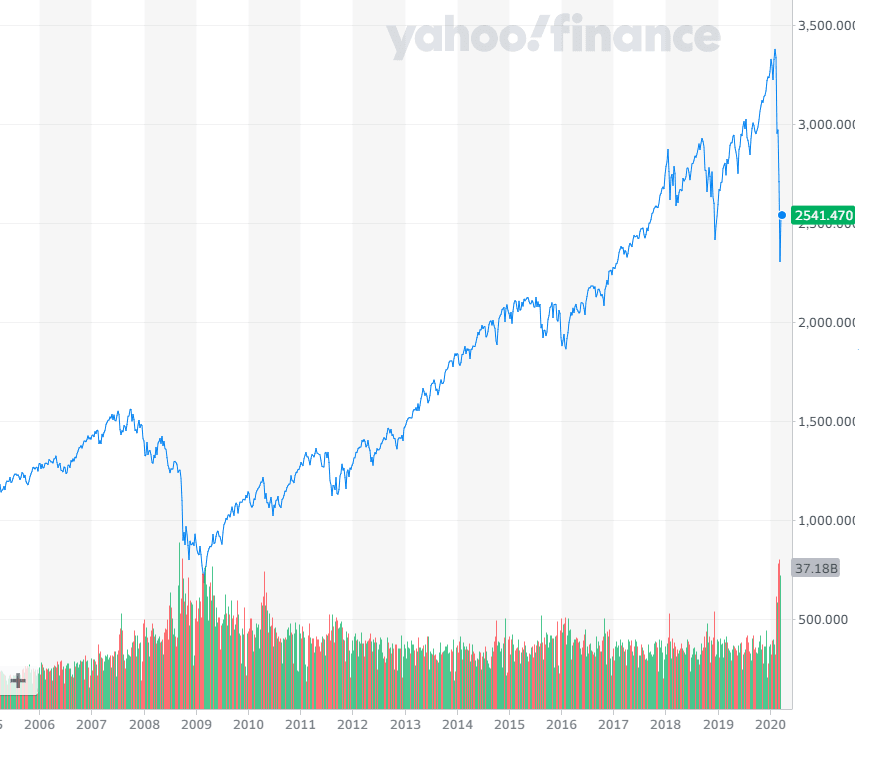

Although the past few weeks were absolute carnage on the markets, we still haven’t hit levels seen during the Financial Crisis of 2008-2009. And as the S&P 500 chart below shows, we haven’t even gone down the 2008 peak. So we may have a bit to go yet, some are saying maybe another 30%…Yikes! Regardless, I’m still buying because in 5 years I’ll be happy I bought this dip.

Stocks will probably be in the gutter for the next few months, maybe longer, so if I continue to throw all I got into the market my dividend income should soar. That is, of course, if none of my companies cut their dividend.

Investing in a Bear Market

The markets have been all over the place again this week. First, Monday was a bad day, the market hit new lows. Tuesday to Thursday the market rallied hard and by the end of Thursday we were about 20% off the February highs. Friday was another down day, with selling accelerating into the close.

What will Monday bring? I’m hoping a retest of the lows so I can buy some cheap stocks again.

I went into this thing with a good chunk of cash on the sidelines. If you’ve read the past few months of my recap posts then you’ll know that I just couldn’t understand how the market was hitting new highs with tons of bad news out there. Luckily, I didn’t succumb to the herd mentality and buy in at the top!

Right now I’m nearly all in on this market. Prices are cheap and the outlook is grim, but a few months from now this may all be behind us and the markets will snap back…or will they?

Right now, it seems like the market is treating the pandemic like a natural disaster where we’ll see a quick recovery once the crisis passes. This is the so-called V shaped recovery that people are hoping for.

The longer this thing lingers on, however, the greater the likelihood of a prolonged downturn and possibly a depression. As of Friday, the jury’s out on which scenario will play out. This explains the wild market gyrations. But one thing everyone seems to agree on is that the longer the world is shutdown, the worse off we’ll be and the higher likelihood of that dreaded D word.

This brings me to some final thoughts on where this is all going.

Globalization and the Post-COVID-19 World

So much coverage has been on what we’re doing to fight the virus and how long until things get back to normal. Very little discussion has gone into what the post Covid world will look like. Will it be back to business as usual or are we in for a more fundamental change?

I think that already there are some huge lessons learned and takeaways from this crisis that will impact the post pandemic world.

Nations around the world will be paying a lot more attention to the security of their food, medicine and other critical equipment supplies. The 2 big questions they’ll ask will be: can we rely on these supplies and can we increase capacity in an emergency.

I think the answer will be a big NO, and that will have implications for global trade as states refocus on domestic production.

The other major impact will involve consumption in developed countries. A lot of people have been laid off and unemployment numbers have soared. Tens of millions are in serious financial trouble and while governments have thrown them a lifeline it may not be enough to keep them from going under, especially if this thing drags on for many more months.

After the crisis, shell shocked households may hold back on spending and focus instead on repaying bills that have gone into arrears and/or building an emergency fund. Either way, demand for anything beyond the necessities may take some time to recover.

Hard –hit industries like travel and oil and gas will also likely take some time to recover.

So we may see a few years of weakness before demand picks up and reaches pre-pandemic levels.

All of this means it may take years for the markets to fully recover.

Thanks for reading and enjoy another weekend of isolation.

How I Manage My Money

In case you’re wondering here’s where I park my money and some financial services that I use:

For my Daily banking and no-fee cash back credit card I use Tangerine. Curious? Check out my Tangerine vs Simplii Financial review and the Tangerine Money Back Credit Card Review.

For my Savings I use the EQ Bank Savings Plus Account. Never heard of it? Click the link to check out my EQ Bank Savings Plus Account Review.

For investing I use a combination of TD Waterhouse (for legacy investments) and Questrade (low cost stock purchases and free ETF purchases). If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.

Dividend Diplomats

Saturday 28th of March 2020

congrats on hitting your 2020 goals and target! Investing is tough right now. But the key, in my opinion, is to focus on finding those quality investments. Who knows if this will be a prolonged depression or a quick recession. Time will tell. That's why quality is key.

Keep pushing forward and enjoy those extra months of DRIPing all of those fancy new dividends.

Bert