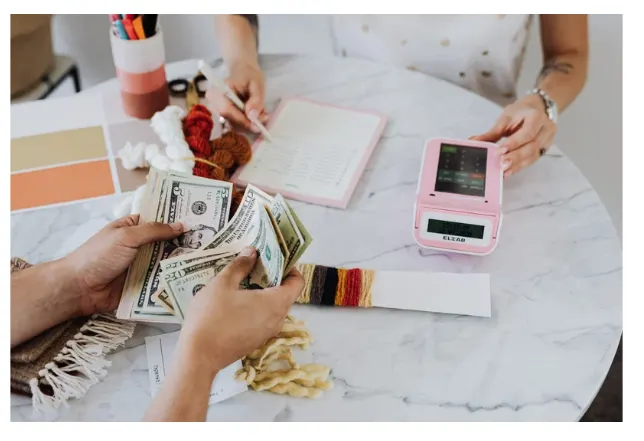

Is Financial Freedom through Passive Income Achievable anymore? Is it possible to reach financial freedom by generating passive income from our investments? What are some risks that come with this wealth creation strategy? All of these questions will be examined in detail below with concrete steps anyone can take to start building streams of passive income today!

Let’s Stop Trading Our Time for Money!

People trade their time for money because it is the traditional way of earning a living. It is how things have been done for generations. In most cases, people trade their time for money by working a job. They exchange their time and expertise for a paycheck. This model has been the norm for many people for a long time. However, many people are now considering alternative ways of generating income, such as passive income, to achieve financial freedom.

What Is Financial Freedom?

Financial freedom is the ability to live the lifestyle you desire without having to worry about money. It means that you have enough savings, investments, and passive income streams to cover your expenses and give you the freedom to pursue your passions, travel, and spend time with loved ones without being tied to a 9-to-5 job or worrying about bills. In essence, financial freedom allows you to have more control over your time and decisions, giving you the opportunity to live the life you want.

How can someone reach financial freedom?

Achieving financial freedom requires a combination of steps such as budgeting, saving money, investing, and generating passive income. Here are some strategies that can help you reach financial freedom:

-

Create a budget: Start by tracking your expenses and creating a budget. This will help you identify areas where you can cut spending and redirect those funds toward saving and investing.

-

Start saving money: Once you have a budget, start saving money on a regular basis. Consider setting up automatic transfers to a savings account to make it easier to save.

-

Invest wisely: Investing in stocks, bonds, mutual funds, and other investments can help grow your wealth over time. Consider consulting with a financial advisor to help you develop an investment strategy.

-

Generate passive income: Passive income streams such as rental income, dividend-paying stocks, and online businesses can provide additional income without requiring a lot of your time.

By following these steps, you can work toward achieving financial freedom and having the resources to live the life you want.

What Is Passive Income?

Passive income is money earned routinely with little to no effort needed to maintain it. In other words, it’s the type of income generated from investments or businesses that do not require your active participation on a day-to-day basis. This includes sources of income such as rental properties, dividend-paying stocks, crowdfunding investments, or creating and selling digital products like e-books or online courses. Passive income can play a crucial role in reaching financial freedom because it can supplement your regular income and help you achieve your financial goals faster.

How to Generate Passive Income

Generating passive income can be achieved through various methods. Here are some strategies to consider:

-

Rental properties – Investing in a property that you can rent out to tenants can be a good way to generate passive income.

-

Dividend-paying stocks – Investing in stocks that provide dividends can be a way to generate passive income on a regular basis.

-

Crowdfunding investments – Crowdfunding platforms allow individuals to invest in various projects such as real estate, startups, or small businesses which can give a good return on investment.

-

Creating and selling digital products – Creating and selling digital products such as ebooks, online courses, or stock photos can be a way to generate passive income especially if you have unique expertise or insights to share.

-

Interest-bearing accounts – parking your money in high-interest savings accounts or certificate of deposits can be an easy way to generate passive income with minimal risk.

These are just a few examples of strategies that can help you to start generating passive income. However, it’s important to remember that every investment comes with varying levels of risk and reward, and you should always do your due diligence and research before committing to any investment.

What Are the Risks Involved with Passive Income

Passive income can be a great way to achieve financial freedom and supplement your regular income. However, like any other type of investment, generating passive income also involves risks. Some risks to be aware of include:

-

Market risk: The value of your investments can fluctuate due to market conditions. For example, the stock market may experience a decline, reducing the value of your portfolio.

-

Default risk: If you invest in bonds or other debt instruments, there is a risk that the borrower may default on their payments, resulting in a loss for the investor.

-

Liquidity risk: Some investments may be difficult to sell quickly, making it challenging to convert them into cash when needed.

-

Concentration risk: If you have all of your investments in a single asset, such as a rental property or a single stock, you face the risk that a downturn in that asset could result in significant losses.

It’s important to carefully consider these risks before committing to any investment. It’s also essential to do thorough research and seek advice from a qualified financial advisor or professional before making any investment decisions.

Is Financial Freedom through Passive Income Achievable?

Yes, achieving financial freedom through passive income is achievable. By following the steps mentioned earlier like budgeting, saving money, investing and generating passive income, you can work towards achieving financial freedom and having the resources to live the life you want. It is important to remember that every investment comes with varying levels of risk and reward, and you should always do your due diligence and research before committing to any investment. Also, seeking advice from a qualified financial advisor or professional before making any investment decisions is recommended.

Save, Invest, Build Wealth and Prosper

In case you’re wondering here’s where we park our money and some financial services that we use (please note these are affiliate links where we receive small compensation for signups and sales):

For our precious metals and coin capsules, we use Silver Gold Bull because they price match and offer fast, insured, delivery.

We also own some crypto currencies like Bitcoin and Ether through Shakepay. If you’re interested in buying some here is our referral link to Shakepay and get $10 to try it out. We buy Bitcoin on Shakepay and transfer it to a Ledger cold storage wallet to keep our crypto secure.

For our Daily banking we use Tangerine because they offer incredible products and no-fee banking.

For investing we use a combination of TD Waterhouse (for legacy investments) and Questrade because it offers incredible value with low cost stock purchases and free ETF purchases. If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.

Please note: this page contains affiliate links. As an affiliate, this blog receives a commission for each sign up for Tangerine, Shakepay, Borrowell, Questrade, Amazon, Silver Gold Bull and Bluehost.

Thanks for reading Is Financial Freedom through Passive Income Achievable?

Gerry

Friday 16th of June 2023

Interesting stuff. I have a 1977 Canadian Nickel Diving Dollar, but can't find info on it anywhere. Thanks for any info provided. Gerry