Hey everyone and welcome to another recap post on the most important question of the day: is the Financial System Failing? A lot has happened in the past year that would suggest that, yes the entire global financial system is on an unsustainable path. This isn’t meant to be a doom and gloom article but a warning to the average investor about what may lie ahead.

But first, my disclaimer: this post contains affiliate links from my most popular financial wealth building tools where the blog may receive a small commission on any sales from Silver Gold Bull, EQ Bank, Questrade and Tangerine.

The Convergence of Large Deflationary Forces

The 2 big problems in the world today are ageing demographics, the so-called “greying” of the world’s population, and the enormous amount of debt in the global financial system.

The Global Debt Problem

Every major economy is in debt up to its eyeballs and its piling up fast. The graph above shows global public debt at $59 trillion. But total debt is much higher; coming in at a whopping $281 trillion! That translates into a global debt to GDP of 355% which is simply unsustainable.

The twin processes of increasing levels of indebtedness and record money printing threaten to blow up the global financial system. The consequence is that policy makers and central bankers are left with 2 completely unacceptable choices.

To default would bring about the greatest depression in history as record amounts of debt are unwound. Alternatively, to keep printing money will inevitably lead to hyperinflation and destroy whatever value is left in global currencies. Either path ultimately means a declining standard of living for everyone.

The global financial system is built upon and backed up by 1 thing only: confidence. Confidence is fragile and once it’s gone, the powers that be will lose control of the narrative and the entire system will unwind one way or another.

Already countries are planning for such an eventuality with the de-dollarization of global trade. Countries are adding gold to their national reserves and trading in currencies other than the US dollar. These trends are likely to continue and strengthen over time as we become more of a multi-polar world.

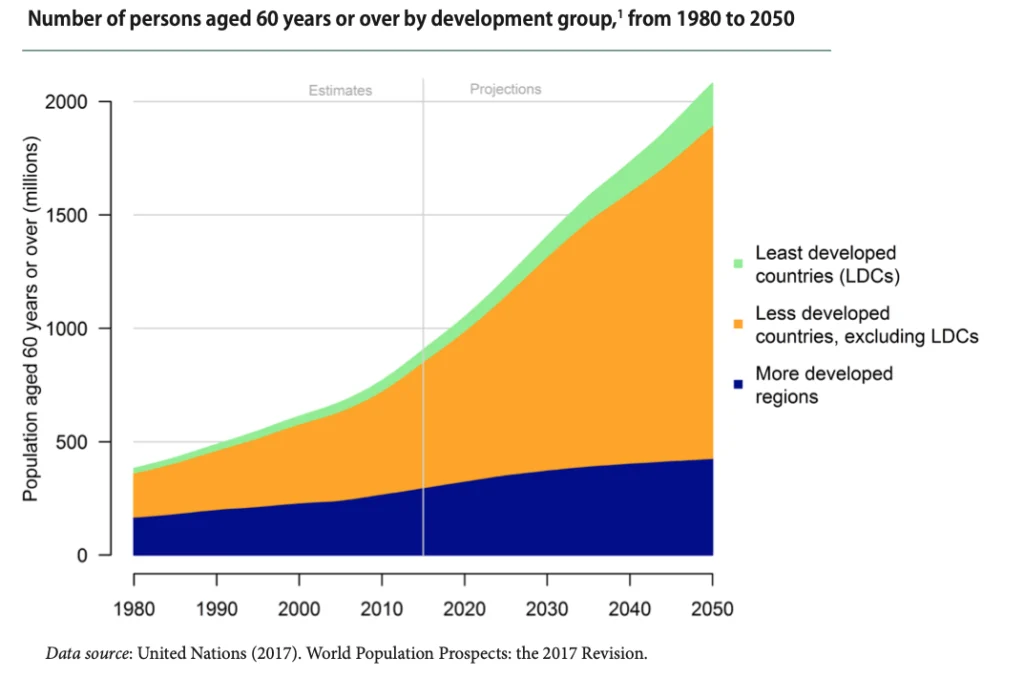

The Demographic Problem

The graph above shows that ageing demographics aren’t just a problem for developed economies, but the entire world. Simply put, as we get older we consume less. A consumption based economy collapses when we consume less. It is quite likely that we will approach peak population in the next few decades.

Central Banks are Gambling With Future Prosperity

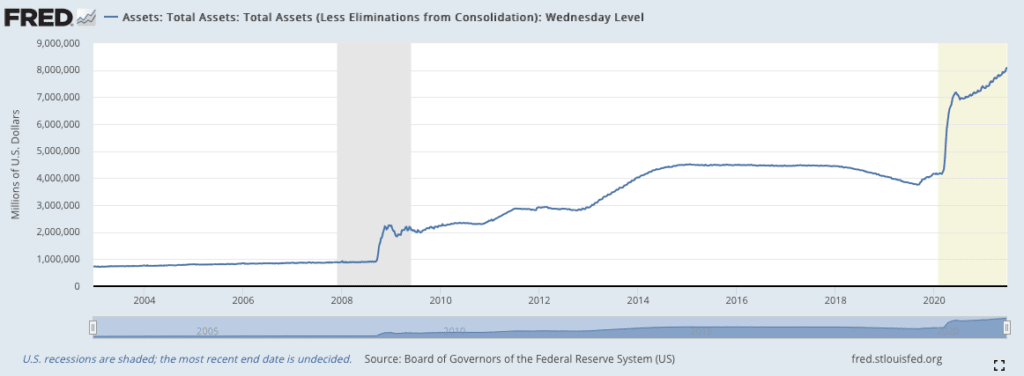

Against the twin deflationary forces of record debt and ageing demographics, central banks have since the Great Financial Crisis of 2007-2009 been trying to create inflation by flooding the financial system with cheap, easy money.

The further down this path we go, the less stable the entire financial system becomes. After all, the solution to a huge debt problem is not piling on even larger amounts of debt! But that is exactly what has happened over the past decade in nearly every country on Earth.

Global central banks, led by the US Federal Reserve, have embarked on a policy of Quantitative Easing (QE) that artificially suppresses interest rates by creating money to buy up Treasury Bills.

The chart below shows the expansion of the US Fed’s balance sheet from 2004-2021. It now stands at $8.1 Trillion…and counting!

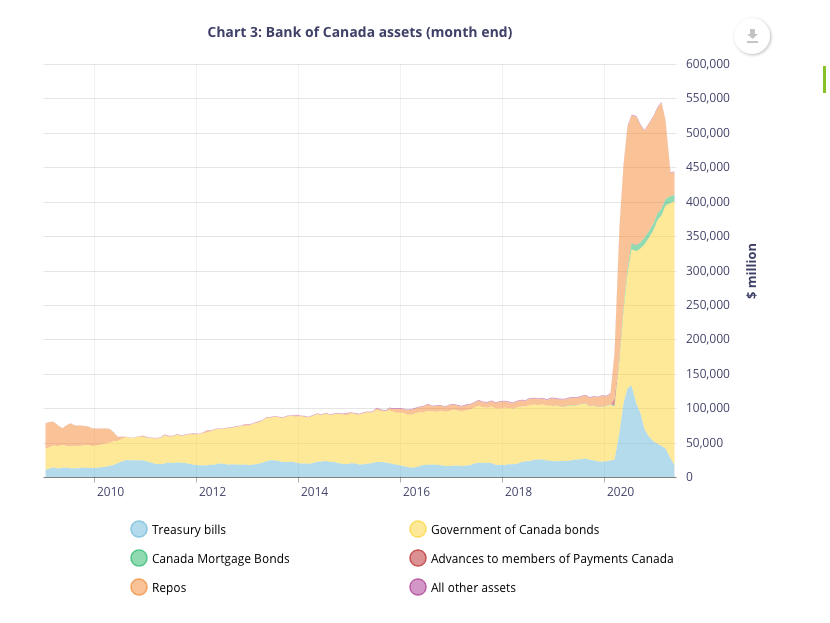

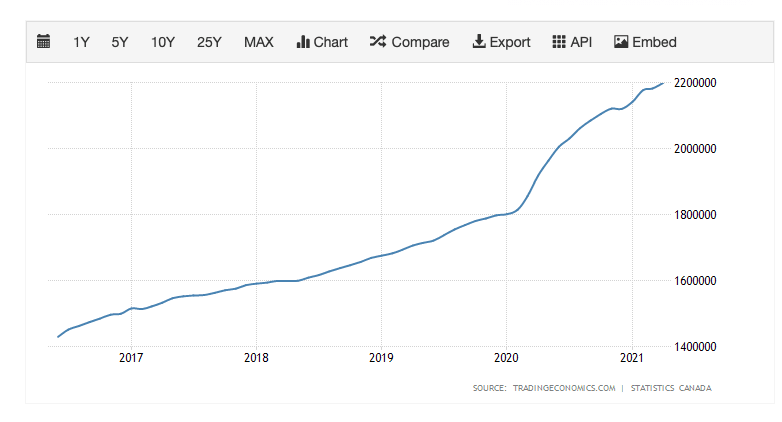

All G7 central banks have followed the Fed down this path. Here’s what the Bank of Canada’s asset purchases look like for the past decade:

What this policy has done is to force everyone from old widows and retirees to pension funds and insurance companies, out on the risk curve by taking on increasingly riskier investments in the stock market.

Asset Bubbles or Currency Depreciation?

One of the most important questions that investors have wrestled with in the past year is whether or not high asset prices are the result of bubbles or a devalued currency.

Stocks, real estate, bonds and crypto are all at or near all-time highs. The easy explanation is that those prices are a result of government stimulus money and the availability of cheap and easy credit at rock bottom interest rates.

Another way of looking at sky high asset prices may be to view them simply as a function of the increase in money supply which devalues the purchasing power of each and every dollar.

Here’s the growth in Canadian Money Supply for example:

Increasing the money supply and record low interest rates has poured fuel on the housing market in particular and other asset markets more generally.

In 2020 US M2 money supply increased by 26%. In Canada that number is closer to 28%. So how much did residential real estate increase by last year? In Canada, the national average home price increased by nearly 40% between May 2020 and May 2021.

The Reckoning

The catch phrase of the past year is that we are in for another Roaring 20s. My belief is that investors had a roaring ’20; and will likely pay dearly for it in the years to come.

Ageing Demographics and record debt levels aren’t exactly recipes for future economic prosperity. At the same time, central bankers can’t print prosperity.

Inflated asset values may make people “feel” richer but ultimately the perceived wealth will prove illusory. Phony investment gains translate into fake wealth that will disappear when the system comes crashing down. All that will be left, as was the case in the Great Depression, is a huge pile of debt and no money to pay it.

The unwinding of this massive global debt bubble will be sudden, violent and devastating. The powers that be understand this so they have embarked upon extreme policies to create inflation in an effort to inflate the debt away.

The big danger for us all is that central banks risk losing control of the entire system.

The Wealthy are Buying Real Assets

So is the Financial System Failing? I believe the example set by the wealthy is instructive.

After all, where does one invest when value, I mean real value, is being destroyed? Well, wealthy billionaires are buying up hard assets like farmland, commodities, gold and real estate. Does it surprise anyone that the largest owner of farmland in the US is none other than Bill Gates?

In the US Blackrock is buying up billions worth of residential real estate to be used as rentals. Recently, a Toronto Developer is spending $1 billion to buy single family homes across Canada for rentals.

Central Banks, wealthy family offices and billionaires are also increasing their gold holdings.

Meanwhile the masses are focused on home price appreciation, crypto and meme stocks like AMC and GME.

Save, Invest, Build Wealth and Prosper

In case you’re wondering here’s where we park our money and some financial services that we use:

For our precious metals we use Silver Gold Bull because they price match and offer fast, insured, delivery.

For our Daily banking we use Tangerine because they offer incredible products and no-fee banking.

For our Savings we use the EQ Bank Savings Plus Account because we need to make highest return possible on our cash savings. Never heard of it? Click the link to check out my EQ Bank Savings Plus Account Review.

For investing we use a combination of TD Waterhouse (for legacy investments) and Questrade because it offers incredible value with low cost stock purchases and free ETF purchases. If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.

Cheers and thanks for reading is the Financial System Failing?

Arthur DuBois

Tuesday 6th of July 2021

Great article here. I completely agree with you and have been saying similar things for years. My only question would be, what do aging demographics have to do with anything? Demographics are always growing older and being replaced by younger ones. I'm also interested to see what happens with crypto during this bubble. Many see it as the future of finance and a global economic meltdown would be the perfect time to transition.

GenXinvestor

Friday 9th of July 2021

Good question about ageing demographics. In all advanced societies and even in emerging economies, people are having fewer kids...so the younger generations aren't enough to support the bulging boomer generation at the top. It means that demand will ultimately fall and that growth will stall then decline. Re: crypto, I think if it blows up I might throw some speculative money at it but I consider it more of a gamble at this point than a genuine investment.

Cheers!