Here are some of the best places to invest your money. Do you want to change your financial future, but don’t know where to start? This post offers a few ways to start investing whether you have money or not.

As usual I have to throw out my disclaimer that this post contains affiliate links where this blog may receive a small commission on signups.

Start an Online Business

The best way to invest if you have no money is to start an online business. You need to be realistic about it and know that starting an online business may or may not work out for you. I recommend starting an online business because it costs so little to get started and the benefits can be huge.

So how do people make money online? Well, there are lots of ways to make money online: blogging, affiliate sales, Dropshipping with Shopify or on Amazon.

If you choose to start an online business, then be prepared to work your butt off with little to show in the way of results… at least initially. Over time however, this venture could turn out to be quite lucrative.

Lots of people make money online. But it’s important to temper your expectations. Very few people become millionaires with an online business; but lots of people earn a decent living. Even more people use the online thing as a profitable side hustle that complements their income from their day job.

The first step is getting web hosting (I use Bluehost) and creating a website. If you want a step by step guide, check out my post on how to start a blog.

The most important thing about owning your own online business is that you get to choose how much or how little time you spend on it. After all, you are your own boss.

Once you start earning some regular cash from your online venture then you can start investing in other things below.

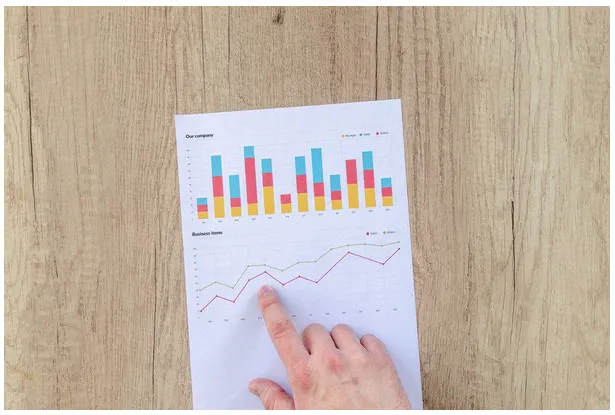

Stocks, Exchange Traded Funds and Mutual Funds

If you have a little bit of money then you should consider financial assets like stocks, ETFs and low-cost mutual funds.

Discount Brokers like Questrade offer free ETF purchases and low commissions to buy and sell stocks. You can start investing with as little as $25 a month. Get $50 in Free Trades! When you signup through This Questrade Link.

The best thing about Questrade is that it’s free to buy ETFs (but not to sell them). For the long term investor, that’s a great deal that allows you to build a low cost ETF portfolio for nest to nothing!

There are lots of benefits to investing in the stock market. Over time, through compounding, reinvesting your dividends and adding new money from your savings, your nest egg will grow and you’ll start receiving a good amount of monthly dividend income. But it takes a lot of money and a lot of time to build a nice passive income stream.

I must admit that this is a slow road to wealth that takes at least a decade before you start seeing significant results. But this has been a tried and tested pathway to wealth for many.

I like financial assets because they are liquid which means that I can sell them if I ever need the money. If you have a large enough portfolio of dividend stocks and ETFs then you might not ever need to sell them at all. In that case, instead of selling your financial assets you could just opt to have your dividends paid out in cash into your bank account.

Invest in Real Estate

Lot’s of people tout real estate investing as an easy way to build wealth. My longtime readers know that I’ve had my own experience with rental properties that I detailed on this blog.

Investing in real estate has made more millionaires than any other investment. But investing in real estate has also ruined many peoples fortunes as well.

Again, I want to be real when I talk about these things because just blindly following an investing trend can seriously hurt you.

First, In the Right Circumstances, I truly believe that investing in real estate is one of the absolute best ways to build wealth and establish a stream of passive income.

Yes, “circumstances” must be right for real estate to be a worthy investment. For example, I believe that a property must truly CASH FLOW for it to be a good investment. So at this time, most Canadian real estate is a horrible investment because it does not sufficiently cash flow and has limited prospects for more price appreciation.

Why do I insist on a property producing sufficient cash flow? Because lots of things can happen to a home that requires lots of money to fix.

If your property doesn’t cash flow then you are effectively subsidizing your tenant’s life!

The truth is that investing in real estate requires investors to take on a huge of amount of risk. There’s a lot of upfront cost for an investor. For instance, it’s costly to acquire and dispose of properties. You have realtor fees, lawyer fees, down payments etc.

Then there are tenant risks. At some point you will get a bad tenant. When that happens good luck with the eviction. Landlord tenant laws almost exclusively protect the tenant while the landlord gets screwed.

I’ve said before that investing in real estate is not great for beginner investors because to do it safely and properly requires deep pockets.

A case in point, I got screwed by my property manager who basically sat on an empty duplex. I had to foot the bill for mortgage, utilities, property management fees etc. All the while, the house sat empty.

How many people could afford to shell out thousands each month in that circumstance?

Luckily for me, I have lots of liquid financial assets and streams of dividend income that I can rely on to get me through that mess. But I didn’t need to tap any of that. Before I bought the properties, I made sure that we could afford to carry them without renters.

So I will reiterate my position that you need deep pockets to safely invest in real estate, because what happened to me happens all the time landlords and investors.

I learned some hard lessons investing in real estate, but that doesn’t mean that I’m turned off by it at all. The next time I invest in real estate I will do things differently. I will apply the lessons learned and things will turn out differently.

I’m not investing in real estate right now because the market is overvalued. Home prices are too high and properties don’t cash flow. People buying rentals today are buying a hope and a dream, not an actual reliable business or income stream.

If the housing market has a healthy correction, then I’ll be ready to pounce. Until then, there are better places for my money with a lot less stress.

Thanks for reading this post on the Best Places to Invest Your Money.