Welcome to my Weekly Recap December 22nd Edition where I discuss some of the key events of the past week and provide an update on what I’m doing with my finances.

Market Meltdown

Of course I’ll be talking about the market meltdown. After the carnage on the markets this past week who isn’t talking about it! But it’s important to keep perspective with these things.

Every few years we experience a market meltdown. While many analysts point out that this is the longest running Bull Market on record, we’ve had plenty of ups and downs along the way. I remember back in 2009 and 2010 they called the fledgling bull market rally a “dead cat bounce.” Next the Greek debt crisis shook the market and then, in 2011, it was worry about the debt crisis with the so-called PIIGS (Portugal, Ireland, Italy, Greece and Spain). Then Gold collapsed, then Oil collapsed, then Crypto, then Weed stocks. Oh and I forgot about all the taper tantrums along the way.

Yes, we’ve been here before. And sure enough, all the bear market prognosticators have come out from hibernation to say that this time is different, it really is the end of the world!

If you invest in the stock market, then it’s important to remember that corrections and bear markets are normal. They’re not necessarily fun for anyone, but they do regularly occur. For some it’s the end of their retirement dream, while others see it as an opportunity.

I try to invest by following Warren Buffett’s saying: “be greedy when others are scared, and be scared when others are greedy.” Or something like that. Basically, to be successful as an investor do the opposite of what everyone else is doing. That means buying when everyone else is selling and selling when everyone else is buying. It sounds simple but is never very easy.

So the most important thing that I can do right now is to stay calm, stay invested and keep buying shares. In fact I plan to buy more than I usually do. This was the most important lesson that I learned 10 years ago when the Global Financial Crisis caused the markets to collapse.

Markets may fall fast, but they can recover fast too. I don’t know when the next rally will happen but, believe me, it will. When that happens the guy sitting on the sidelines with cash always misses out or buys in too late. The biggest moves tend to happen early on.

If you’re thinking about investing, there’s no better time to start than after the market crashes. So open a Questrade account or check out Tangerine’s investment funds. 2019 is just around the corner and the new annual TFSA limit is $6k! Not to mention RRSP season.

I think the market crash is an opportunity to buy quality stocks for cheap. So for now I’m content to keep buying my favorite companies at steep discounts and to keep on watching that dividend income roll in. Because I want every dollar working for me, I re-invest that income to purchase more shares at these discounted prices. If I keep investing all that I can in this bear market then my passive dividend income will soar in 2019. And while I will most definitely experience some short term pain as my investments decline in value, when the market turns I’ll make out like a bandit!

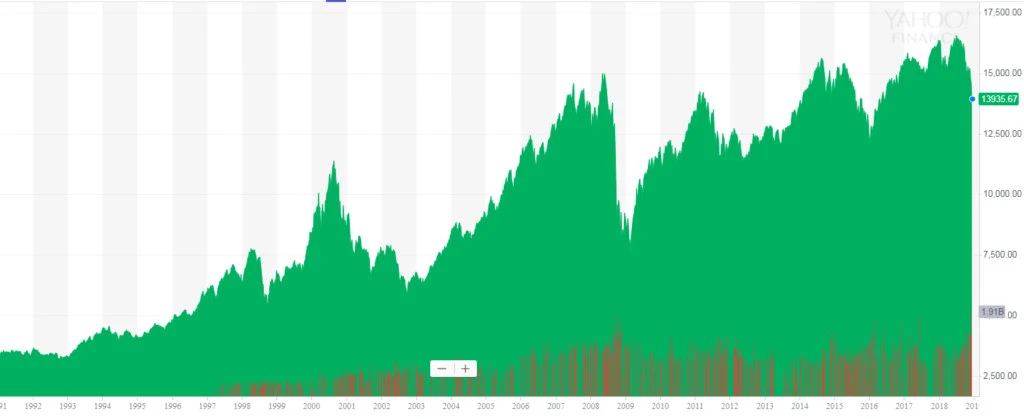

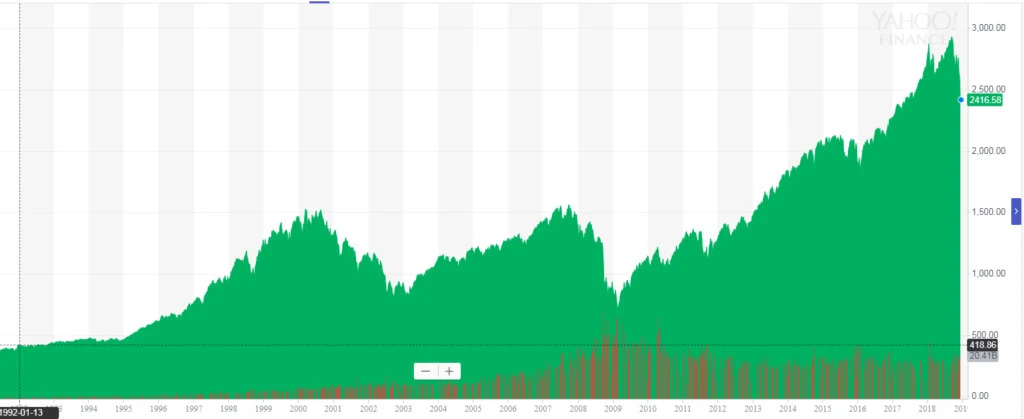

Here’s some perspective for you. Check out these 2 charts below on the rise and fall of the S&P 500 and the TSX. The long term trend is always up and, if dividends are re-invested, investors tend to do very well.

Happy Holidays Everyone! And thanks for reading my Weekly Recap December 22nd Edition.