Ever wonder what happens when money dies? When we look back on this period years from now, will we see all the tell-tale signs of massive global asset bubbles? Will we see how massive deficit spending by governments around the world resulted in currency devaluations, high inflation and lower standards of living across the globe?

Here’s some food for thought I found in some recent headlines:

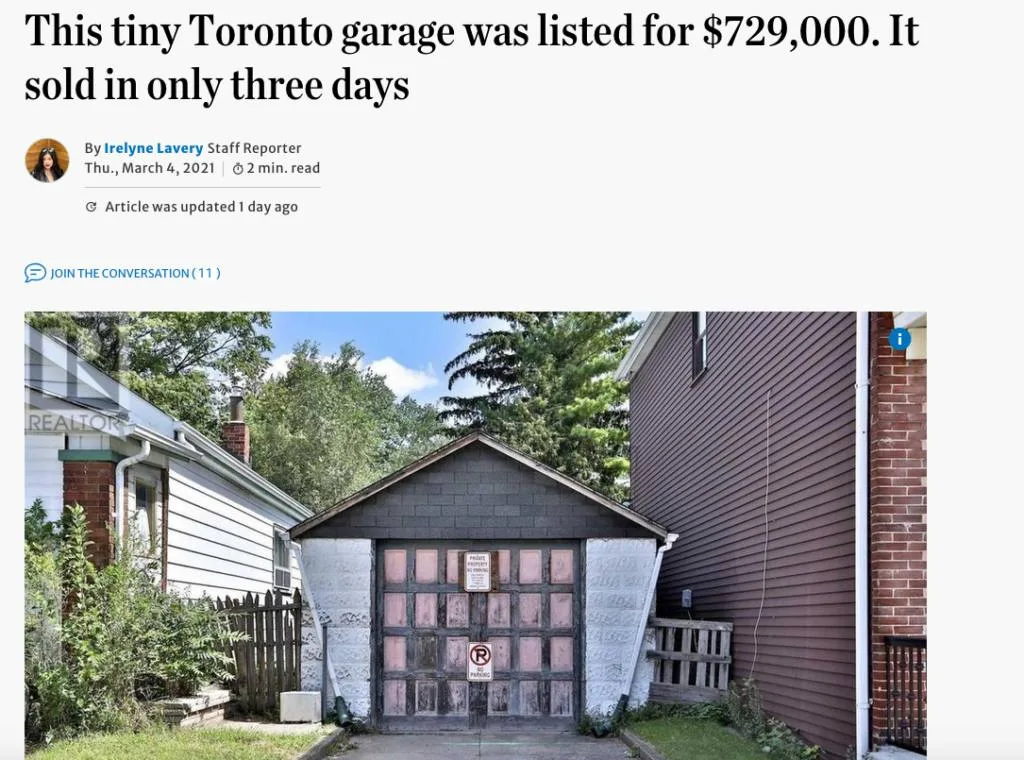

A Massive Real Estate Bubble!

Real estate has skyrocketed around the world amid a deteriorating financial backdrop.

A Massive Stock Market Bubble!

The GameStop saga orchestrated by the Wall Street Bets crowd is just one example of many (SPACs, tech stocks, Bitcoin etc) that point to irrational exuberance in financial markets.

In 2020, Central Banks put a floor on financial markets with cheap money and vowing to buy corporate debt – even junk! Markets no longer trade on any semblance of economic fundamentals but have turned into casinos for the masses to speculate on stocks that should have gone bankrupt.

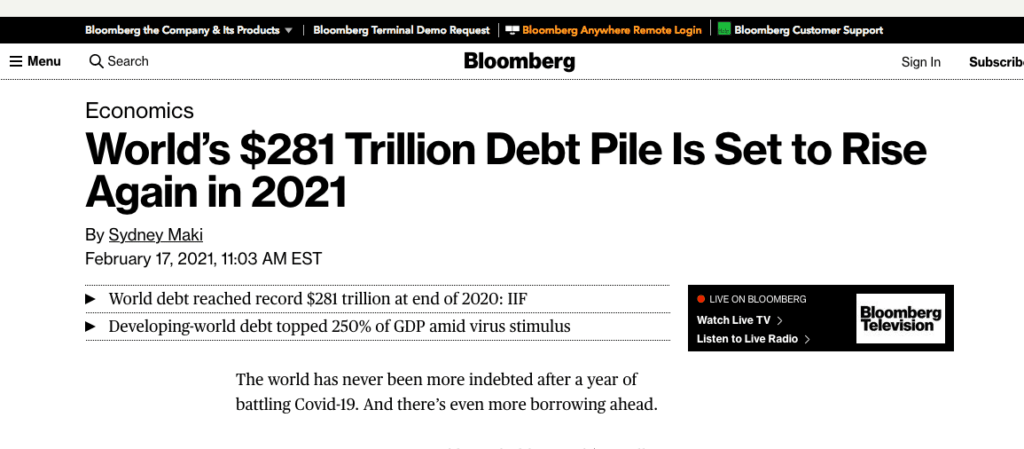

A Massive Global Debt Bubble!

All the major world economies are considerably worse off than they were pre-pandemic. The global debt burden is that much more harder to deal with. This will make the next crisis even harder to deal with and possibly collapse the global financial system.

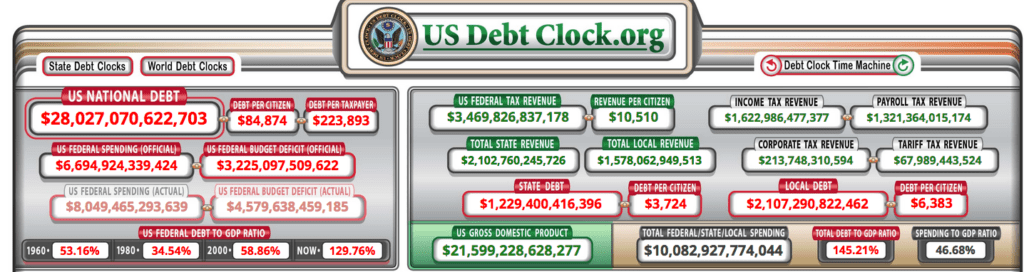

The world’s reserve currency is the US dollar. The US currently has a national debt of over $28 trillion! As more debt keeps piling on, more and more voices are calling into question the USD’s status as the worlds’ reserve currency.

Canada is no better off. Since Trudeau took office in 2015, his government has piled on record amounts of debt with virtually nothing to show for it. Where is the new infrastructure and much needed repairs to the old infrastructure?

At some point, Turdeau’s “Sunny Ways” will give way to reality: massive tax hikes and a weak economy.

2 Possible Bad Potential Outcomes

Today, we are at a crossroads:

Deflationists argue that global debt bubbles will collapse and crash the stock, bond and real estate markets. Added to this will be the demographic impact of the Baby Boom generation selling financial and real estate assets for retirement income.

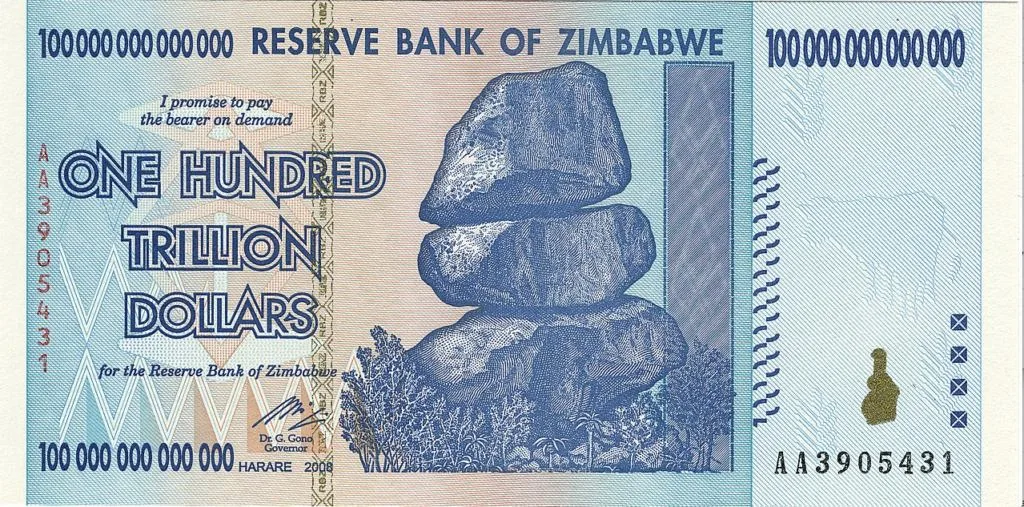

Inflationists argue that central bank and government stimulus will continue, and result in high inflation or even hyperinflation if they lose control. In that case real assets like gold and silver and commodities will do well.

In either scenario we all face a reckoning. So how can we prepare for quite different outcomes?

How To Prepare

Whether we get a big economic crash and deflation or high inflation – maybe even hyperinflation – I think the playbook is the same for the average person.

Pay Down Debt

Pay off as much debt as you possibly can. In prior deflationary busts we saw mass unemployment and the seizing of the financial credit system. If you had debt in the form of a mortgage on your home and lost your job the bank foreclosed on you. We saw this in 2008-2009 in the US during the Global Financial Crisis.

If we get high inflation or even hyperinflation anyone holding debt will be hit with high interest rates as happened in the 1970s and early 1980s. Needless to say that if you’re sitting on a massive pile of debt and we get higher interest rates then you will suffer under crushing debt payments.

During the Weimar hyperinflation of 1923 consumer mortgages didn’t inflate away. Instead, they were re-priced in terms of gold and the consumer was forced to pay much more. So don’t believe that holding massive amounts of mortgage debt is okay because it will be inflated away!

In both scenarios paying off debt is prudent.

Own Different Asset Classes

The Case for Cash

In deflation, cash and treasuries are king. So even at today’s low interest rates I think people should have an emergency fund at the very least. Look at how quickly things came unraveled in March 2020.

Cash is important for people because it provides the liquidity to meet their living needs and debt obligations.

Sadly, as we saw in 2020, companies cut their dividends during hard times and this can hurt investors who were all in on dividend stocks with the expectation that the streams of cash flow will always be there.

We also saw landlords get hurt when tenants didn’t have to pay rent and couldn’t be evicted. So even the income stream from cash flowing real estate can dry up in a crisis.

The point is that having cash on hand in a crisis is a very good thing.

Real Assets and Commodities

In situations where we get high inflation, commodities are the place to be. Things like gold and silver, oil, timber and agriculture do particularly well. For the average person though it is very difficult to directly gain exposure to these with the exception of physical gold and silver bullion.

For oil, lumber and agriculture, there are individual stocks and ETFs to invest in.

Gold and silver do particularly well in inflationary scenarios. Gold also holds up better than other assets in deflation – it just goes down less.

Stocks and Bonds

In either scenario of inflation or deflation stocks generally don’t fare well at all. In deflation stocks dropped as much as 90% in the Depression. The 1970s stagflation was a lost decade for stocks.

Government Bonds held up well during the Depression as investors rushed to safety in an effort to keep their principal intact. By contrast, bonds got killed in the 1970s as currency depreciated.

Where Are We Headed?

In many ways, making future predictions about financial markets is a fool’s errand. Even the best informed, most educated minds have failed time and again to get things right.

Personally, I find compelling arguments are made on both sides of the inflation/deflation debate. Some even link them by calling for a massive deflationary bust that will result in massive stimulus that will end up in hyperinflation.

In the aftermath of the Global financial Crisis of 2008-09, central banks around the world dropped interest rates to zero and began massive quantitative easing programs (QE).

These programs were accepted as needed emergency measures to prevent the total collapse of the global financial system. It was also understood that these emergency programs would eventually end and that interest rates would slowly normalize.

In 2016 the US Fed started this process before having to reverse course in late 2018 after economic growth slowed and the stock market had a big correction known as the taper tantrum.

Then in September 2019 there was a crisis in the overnight repo market where commercial banks lend to one another. This kick started a new QE program that was ramping up just as the pandemic emerged and shutdown the global economy.

Once again central banks brought interest rates to zero and started the largest stimulus program since World War 2!

We need to ask ourselves how much longer things can go on like this. I think it’s becoming increasingly clear that we are setting up for one of the extreme scenarios outlined above. So as investors we need to focus on preserving our wealth by holding some assets like cash and commodities that we have moved away from over the previous decade.