Will Rising Interest Rates Pop Global Debt Bubbles? Yesterday the US Fed hiked its key overnight interest rate by 0.75% and said more hikes are on the way as Central Banks around the world hike interest rates to battle record high inflation. What impact will these moves have on global debt, which sits above $300 trillion. My guess is that it’s on the brink of collapse and I’m seeing some canaries dropping.

But first, my disclaimer: this post contains affiliate links from my most popular financial wealth building tools where the blog may receive a small commission on any sales from Silver Gold Bull, Questrade and Tangerine.

The Growth of Global Asset Bubbles

For over a decade anyone who bought any type of asset (like stocks, bonds and real estate) look like financial geniuses! How did everyone do so well? Did they pick the right stocks like a Google or Amazon? Or did they just buy passive index funds that have been all the rage?

What about real estate? It didn’t seem to matter if you bought a suburban castle or a piece of shit garage in Toronto that sold for above $700k in March 2021. Everyone hit the real estate jackpot!

What about rental properties? So many Canadians got high on HGTV BS and decided that land lording was for them and a foolproof way of getting rich.

Even if you were totally risk averse and parked your cash in a 60/40 stock/bond balanced portfolio, you did very well.

I think as investors we need to realize that it wasn’t because we are all mini Warren Buffetts or billionaire real estate tycoons that we enjoyed remarkable rates of return on our investments.

It’s time we all come to grips with the reality that our collective prosperity and investing profits was in large part the result of rock bottom interest rates and massive credit expansion (ie. debt).

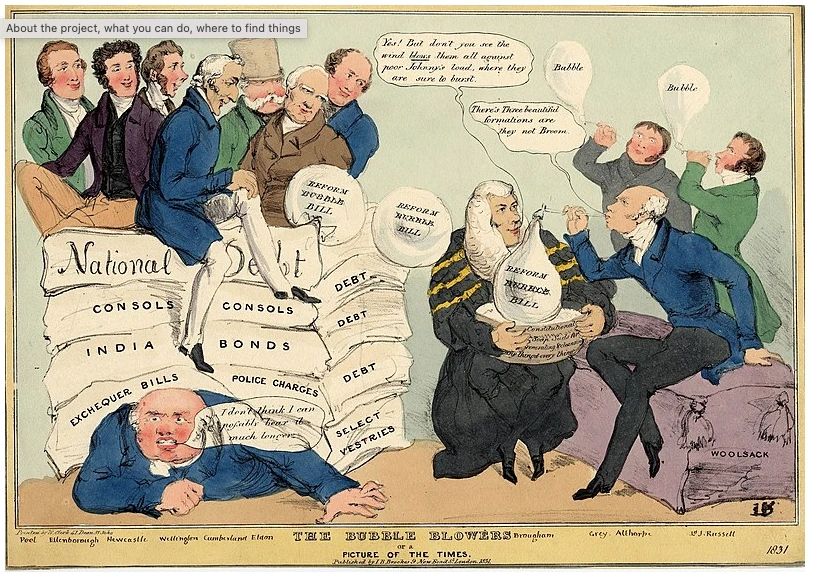

Biggest Bubbles In History

Throughout history the combination of cheap money and free and easy lending conditions have fuelled massive bubbles and rampant speculation.

Some notable examples of this :

The Australian Land Boom and crash 1890s (25 year depression)

The Wall Street Crash of 1929 led to the Great Depression (it took until 1954/1955 for asset prices to return to the pre crash levels)

The Japan Real Estate and Stock Market Bubble of the late 1980s resulted in possibly the largest crash in history. By the way, Japan invented QE or quantitative easing that aims to suppress interest rates and finance government and corporate debt. The result is that Japan’s stock and real estate markets have not recovered to their 1989/1990 peak.

Of course everyone remembers the Great Recession and Global Financial Crisis of 2007-2009 where the implosion came within a few HOURS of destroying the global financial system.

All of these bubbles eventually bursts due to a combination of bad loans, tightening credit conditions and increasing the cost of money by increasing interest rates.

Canadian Real Estate Market will Face a Severe Correction

Let’s not kid ourselves our homes, our castles, the symbols of the Great Canadian Dream will decline in value and may take a while to recover (if ever). So if your home was your retirement plan then you’re screwed.

A few short months ago, Canadian real estate prices peaked at the highest price in history. It was and is common for homeowners in hot markets like GTA and GVA to carry a $1 million mortgage balance.

For the rest of Canada it’s not so bad but even in those areas, homeowners are carrying a ton of mortgage debt relative to local conditions and incomes.

Many Canadians borrowed huge to buy a home and ran up huge balances on their HELOCs to finance renovations and other things. A lot of this money is subject to variable rate interest which means as rates rise so does the carrying cost on this debt.

Even more terrifying is there is anecdotal evidence that many boomers took out HELOC debt on their current home to help junior get his or her first home. So we could be faced with a double whammy of junior having to sell a home he can’t afford and mom and dad take the hit.

Already we are seeing massive declines in both sales and prices. According to Yahoo Finance, sales have fallen by 22% since last year (2021), but the month over month number continues to decline and will likely continue for the foreseeable future.

Prices in May 2022 have fallen in some of the hottest markets by nearly 20% from their peak in February/March. That’s a drop of $400,000 on your average $2 million home in the GTA and GVA. That’s home equity that has gone to equity Heaven. I wonder what will happen when banks decide to do reappraisals?

Global Stock Markets are Buckling

As interest rates rise stocks are getting killed. Already the high flying Nasdaq and Cathy Wood’s Ark fund was getting killed as the market peaked back in November 2021. The Nasdaq is currently down 33.11% from its peak. The S&P 500 is down 22.57% from its peak. Finally, the TSX is down a measly 12.5%.

Yes, Canada’s stock market has fared much better because the world has record high inflation and the TSX is essentially a commodities market. I think the TSX will go much lower. Higher rates will reduce demand and cause commodity prices to drop. There’s an old saying that Commodities take the stairs up and the elevator down, so look out below.

Eurozone stock markets are a disaster as expected due to low economic growth caused by war, inflation and sky high debt.

The Chinese markets are no better after CCP crackdowns on companies that operate globally (ie. Alibaba etc) and deflating the massive property bubble (ie. Evergrande).

Bitcoin and Crypto Getting Killed

All those crypto believers HODLing have fallen for a modern day Ponzi scheme. One chart says it all!

Cryptos and Bitcoin in particular are not digital gold. There is no substitute for gold.

Global Currency Crisis Developing

When interest rates rise, the price of gold usually drops so what gives? Why is gold holding up so well? I think the answer has to do with the coming currency crisis.

This is a gross oversimplification but here’s the gist of it. Since the GFC 2007-09, G7 countries ran up huge deficits and issued tons of debt (ie. government bonds). In order to prevent a debt collapse, each country’s central bank bought those bonds under QE programs to keep interest rates low and the debt affordable.

After all, it’s only common sense to demand a higher interest rate when we lend money to entities that continuously borrow more and more. Eventually the ability of the borrower to repay the loan is called into question. As individuals we don’t have the ability to buy our own debt to keep our interest rates low, but a national government with a central bank does.

It’s been a running joke that interest rates in the Eurozone have been negative for the better part of a decade and in Japan they have been effectively zero for a while.

Even the USA had zero rates for a while. Lucky for us the Bank of Canada was much more responsible keeping the interest rate at 0.25% (sarcasm)!

The Inflation Problem

Record low interest rates and high debt are totally fine unless… Inflation makes a big comeback. Supply chain disruptions coupled with massive global demand fuelled by Stimmie checks, CERB and mortgage and rent holidays and every other pandemic stimulus program has fuelled the reemergence of inflation.

Simply put, inflation destroys our money’s purchasing power. Think of it as many dollars chasing few goods.

Remember all the Pandemic budgets? They were financed by debt issued by governments and bought by their central banks. That kept interest rates and fuelled asset prices inflation like stocks, bonds, real estate etc. We had that in the aftermath of the GFC too. And it made investors look like geniuses and those who religiously “Buy the Dip” market gods.

That’s fine and all good. But governments did something they did not due in 2008 and 2009. They gave money…checks to people and businesses. And people spent them. That is inflationary.

My guess was that inflation was going to be transitory like they told us. After all the money’s been spent and no more is coming. But Covid lockdowns in China and a developing energy crunch that turned into an existential crisis with the Ukraine invasion has changed all that.

Now inflation is building on itself and more importantly and alarming for central bankers is that it’s changing people’s psychology. Employees demand more wages to keep up with the cost of living, people are buying more necessities because things at the grocery store keep getting more and more expensive. Gas prices and energy costs are through the roof and have risen astronomically in Europe.

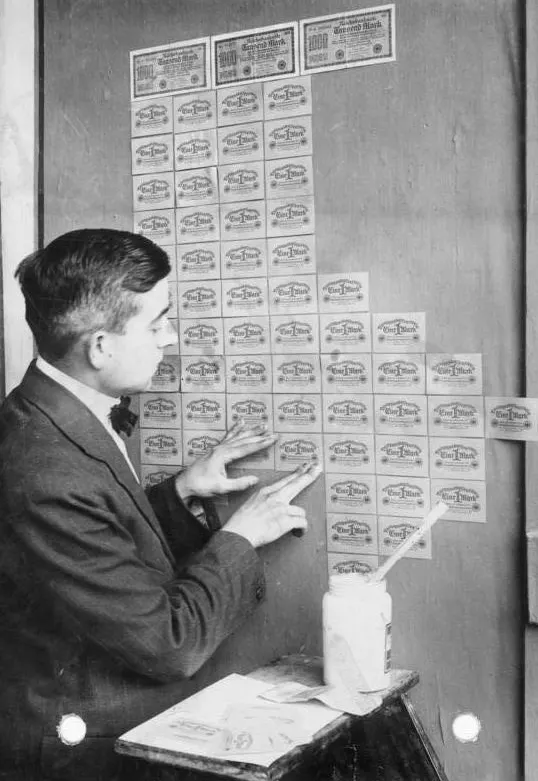

There is a real possibility that inflation gets out of control like in the 1970s. Of course the absolute nightmare scenario would the dreaded hyperinflation ala Weimar Germany where people used paper money as wallpaper and a wheel barrow full of cash bought a loaf of bread.

Country’s like Turkey have been dealing with this since 2020.

A Tale of Two Currency Regimes

To fight record high inflation country’s need to raise interest rates from record lows of zero or negative to somewhere near or higher than the prevailing inflation rate. Right now inflation in the US is above 8% and in Canada above 6%.

These are government numbers, the true inflation as calculated back in 1980 is around 15%-20%. Over the years government statistic bureaus have removed anything from the inflation basket that actually showed signs of inflation. Things like food and energy are too volatile according to them to include in that calculation.

So to effectively fight inflation governments need to raise interest rates to their expected level of inflation which today sits around 4%. No country can really afford to do this with record high debt and massive asset bubbles but they need to try, otherwise Weimar.

The US, Canada, Great Britain, Australia are all hiking rates until something breaks. But the Eurozone and Japan can’t. Japan has defended the 0.25% level on its government bonds. So it currency, the Yen is dropping in value relative to other currencies like the US dollar. Japan faces a debt collapse or hyperinflation…not a good position to be in.

The Eurozone is a basket case. ECB president Christine Lagarde this week faced awkward questions about how the ECB will stop QE bond buying when countries like Italy and Spain would face a debt crisis like the one in 2010-2012.

There is a very real possibility that Yen and Euro could collapse. That is a big deal because they are among the top 3 (USD is #1) in global currency markets.

No one really knows what would happen if Japan in particular went bust, not to mention the Eurozone. The knock on effects would likely pale in comparison to 2008/2009.

The practical reality is that even the US, Canada etc, will be forced at some point in the near future to stop hiking rates because the economic consequences are just too painful.

That is the reason that gold is holding up so well, I think.

Finding Safety in a Turbulent Market

I believe there are huge risks that most people are not aware of and that policy makers are grossly underestimating. That’s why I have been focusing on financial security these past few years.

What does financial security look like? Here’s my template:

Being completely debt free including no mortgage,

Having Cash that does nothing for us but sit and earn interest at Tangerine,

Owning commodity stocks for inflation protection

Owning assets outside the banking system like physical gold and silver, Bitcoin in cold storage wallet and physical cash.

Save, Invest, Build Wealth and Prosper

In case you’re wondering here’s where I park my money and some financial services that I use:

For our precious metals we use Silver Gold Bull because they price match and offer fast, insured, delivery.

For our Daily banking we use Tangerine because they offer incredible products and no-fee banking.

For investing we use a combination of TD Waterhouse (for legacy investments) and Questrade because it offers incredible value with low cost stock purchases and free ETF purchases. If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.

Thanks for reading Will Rising Interest Rates Pop Global Debt Bubbles