What makes investing such a lucrative activity is the power of compounding. Einstein once famously described compound interest as the “eighth wonder of the world.” In this article, I’ll be looking at the power of compounding and why it’s so important. After all, one of the great things about investing is the boost your nest egg gets from the power of compounded growth.

What makes investing such a lucrative activity is the power of compounding. Einstein once famously described compound interest as the “eighth wonder of the world.” In this article, I’ll be looking at the power of compounding and why it’s so important. After all, one of the great things about investing is the boost your nest egg gets from the power of compounded growth.

What do we mean by Compounding?

Investopedia defines compounding as “the ability of an asset to generate earnings, which are then reinvested in order to generate their own earnings…[it] refers to generating earnings from previous earnings.” Basically, when you re-invest your investment income, that money earns money and so on. It’s the snowball effect – small amounts over time add up to large sums. As time goes on, the growth accelerates and the greater your nest egg will be.

How do we get Compounding to work for us?

To really get the power of compounding working for us, we need to do 2 things:

- Start saving money and invest it in income producing assets. An income producing asset is an asset that pays you to own it. It can be earning interest from cash sitting in a savings account at a bank, or interest earned through a Canada savings bond. It can be from owning stocks that pay a regular monthly or quarterly dividend. It can even be from owning a mutual fund or an exchange-traded fund (ETF) that pays a monthly or quarterly distribution.

- Start re-investing your investment income. Once you own an income producing asset, you have the option to take the money generated from it in cash or to re-invest it. For example, I receive quarterly dividends from the stocks that I own. I could take the money in cash and use it to help pay my monthly bills etc. Or I can re-invest it back into my stocks which will generate even more dividend income. As a rule I always re-invest my dividends (see my articles on Dividend Re-investment Plans or DRIPs)

Why is Compounding so important?

Compound growth serves as a force multiplier in an investment portfolio. It is making your money work harder for you so you don’t have to. The great thing about re-investing your investment income is that you will eventually reach a point where the amount of money being re-invested is greater than the money that you contribute from your savings. All you need to do is start saving and investing your money and, over time, let compounding do its work.

The difference Compounding makes over time

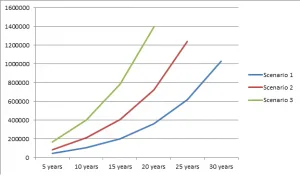

Early on I realized the importance of compounding. When I began saving and investing in earnest at age 27, I looked at an online compound interest calculator and ran different scenarios. Here are 3 scenarios that illustrate the power of compounding.

In scenario 1, if a 27 year old saves $100/week or $5200/year for 31 years at 10% compounded annually, that person would have amassed $1,040,716.39 by age 58.

Now, for scenario 2, if that same person doubled the amount used in scenario 1 to $200/week or $10,400/year, for example, they would reach the 1 million dollar mark 7 years sooner at age 51.

Finally, if that person managed to save 20k a year, after just 18 years they would have amassed over 1 million dollars at age 45.

Click to enlarge image

As you can see, the more you save and invest at a young age, the more your money works for you over time and the sooner you’ll achieve financial freedom. These scenarios also demonstrate the importance of the variables that influence compounding.

What are the variables that influence compounding?

There are 3 main variables that impact compounding. They are:

- Principal (ie. the amount of money invested)

- Time (ie. the time horizon for the investment)

- Rate of Return (ie. what you expect your investment to return)

As they are inter-related variables, let’s take a look at each of them more closely.

Principal

Your principal is the amount of money from your personal savings that you invest in an asset. It goes without saying that the more money you start out with, the more money it will make and the faster it will grow over time. Most people don’t have a huge amount of money when they begin to save and invest, so they start out small and grow their principal over time. Personally, I prefer to use automatic savings/investment plans as the minimum amount is only $25.

Time

Most financial experts focus on the importance of the time factor in compounding for a couple of reasons:

- the longer the time frame, the more compounding occurs at an ever-accelerating pace.

- the longer the time frame, the less money is needed to reach the financial end goal which is, in the example above, achieving 1 million dollars. Here are some examples that illustrate the point. In scenario 1 above, a person need only save $100/week at age 27 to have 1 million dollars at age 58. But if that person chose to wait 10 years and start saving at age 37, they would have to save nearly 3 times as much ($288/week) to hit the $1 million mark at age 58. It’s even worse if they waited until they were 47. At that age, they would need to save nearly 10 times as much ($961/week) to hit the $1 million mark.

Rate of Return

The power of compounding, however, is not just about the amount of time and the amount of money that goes into it. The rate of return is also an extremely important variable, but one that is completely out of our control. Achieving an average annualized rate of return of 10% is probably unrealistic for most people at a time when bond yields are at all-time lows.

A report by Vanguard that looked into the historical rates of return for a variety of investment portfolios found that from 1926-2013, the average 60/40 stock/bond balanced portfolio’s rate of return was 8.9%. To achieve a 10% rate of return, according to that report, would require a 100% investment in stocks, which is simply too risky for the average person. Many financial analyst agree that achieving a double-digit rate of return is probably unlikely for most people, so they need to concentrate their efforts on the 2 variables that they do have control over: time and the amount of money that they are saving and investing.

Compounding and today’s retirement crisis

Having a greater sense of the importance of the variables that influence compounding makes it easier to understand the role they play in today’s retirement crisis. Report after report finds that:

- People haven’t saved for retirement, or that

- People haven’t saved enough over the years, and that

- People are unlikely to achieve a high rate of return on their investments.

These are quite sobering facts. How do they translate into the real world? Well, it means that people will have to:

- take more investment risk to achieve a greater return. This has already happened as traditional bond investors seek higher yield in dividend stocks, real estate investment trusts (REITs), preferred shares and riskier corporate and high yield “junk” bonds.

- People are having to save more money nowadays; which explains the sluggish economic growth that we have seen in a variety of reports since the financial crisis of 2008. The more money that people save, the less they spend, which means that fewer goods and services are required.

- Finally, people simply have to work longer and delay their retirement. This too has economic consequences as we now have record high youth unemployment and it is taking university graduates much longer to find a job.

So what can we take away from this article?

Well first off, I think it goes without saying that to leverage the power of compounding, it is important to start saving and investing early. I started at age 27 and wished that I had started much earlier!

The second take-away from this article is to try to save as much as you can comfortably afford to and increase that amount over time.

Finally, I think it’s important to consider the level of risk that you are willing to take to achieve a certain rate of return. In general, financial experts have traditionally recommended that the younger you are, the more heavily weighted your portfolio should be with equities. As you get older, they recommend reducing risk by tilting the weight of the portfolio more toward fixed income. That said, there are many bloggers out there that swear by their blue-chip dividend-paying stocks. But that approach will certainly be determined by your personal level of risk.

Photo Credit: Image courtesy of Stuart Miles / FreeDigitalPhotos.net